Restoring the ancient spiritual Economy of Merit Coins in a Favour System of Chivalry, as reestablished by the medieval Knights Templar, empowering the People to reclaim Common Law human rights against abuses of power.

Historically, the Order of the Temple of Solomon, the sovereign institution of the legendary Knights Templar, operated its own Sovereign Coins economy, by and for the People, all driven by an egalitarian system of meritocracy. This Templar Coins economy applied timeless principles from ancient rules of customary international law, promoting a spiritual economy under God’s Natural Law as Common Law, instead of a secular economy under parliamentary laws as statutory law.

Historically, the Order of the Temple of Solomon, the sovereign institution of the legendary Knights Templar, operated its own Sovereign Coins economy, by and for the People, all driven by an egalitarian system of meritocracy. This Templar Coins economy applied timeless principles from ancient rules of customary international law, promoting a spiritual economy under God’s Natural Law as Common Law, instead of a secular economy under parliamentary laws as statutory law.

The authentic Templar economy is driven by the use of Religious Coins, representing “moral currency” of “moral value” of Merit in Chivalry, as a medium of exchange in an ancient Favour System of “priceless” earned Merit under God’s Law.

In contrast, modern “Money” uses Secular Coins as “monetary currency” of “monetary value” of “fixed” trade units in commerce, as a medium of exchange for commercial goods and services under modern governmental law.

Templar “Merit Coins”, called simply “Merits” for short, are a revival of the most ancient primordial “Golden Age” economic technology of humanity as created by God. The original Knights Templar restored this system as medieval Templar Sovereign Coins, representing the spiritual economy of the Kingdom of God, solidly backed by the True Value of earned Merit through humanitarian missions of the Templar Order.

As the moral currency of a Favour System in Chivalry, each Merit Coin is redeemable for one Favour, based on one’s earned Merit deserving that Favour, or is given to reward one Favour received, based on one’s gratitude for another’s earned Merit by giving that Favour.

The practical “True Value” of each Merit Coin is “priceless”, opening the door to private access to exclusive services not offered to the general public nor in commerce, or special help or privileges which are personal Favours. They are thus literally “worth more than money”, allowing asset protection and giving freedom to operate “outside the system” in a non-monetary economy.

The economic “Real Value” of each Merit Coin, as its timeless purchasing power, is that of “One Service Horse” as a living creature of God, which is indirectly equivalent to $1,000 USD in modern times (as of 2020).

A complete understanding of the authentic Templar Coins Economy, for real-world practical use in the modern era, can only come from a comprehensive restoration, integrating diverse academic specialties. That restoration is fully presented in this report, combining the expertise of historians, archaeologists, anthropologists, and economists, and illustrating this intuitive economy through major films in modern popular culture.

One sphere of “lost” Templar knowledge (of course, now “found”) reveals that there is much more to the economics of civilization than merely “Money” of monetary currencies of secular governments.

One sphere of “lost” Templar knowledge (of course, now “found”) reveals that there is much more to the economics of civilization than merely “Money” of monetary currencies of secular governments.

Indeed, there is a major role of the Kingdom of God in human economics, adding another whole dimension far beyond all concepts of a worldly monetary system. Accordingly, in nature there exists a parallel “economy” in the realm of spiritual and moral affairs, which can assert its own spiritual Sovereignty for positive influence in worldly affairs.

God’s Economy of Favours – Anthropology reveals that from the beginning of known human history, ancient cultures were originally based upon a “Gift Economy” [1], in which goods and services were given in a system of “reciprocal exchange” governed by “social norms and customs” [2], as “non-market exchange” driven by “morality” [3].

In this system, “gifts” were given out of a sense of moral obligation, as a form of “community service”, embodying and upholding the cultural identity, heritage and traditions of the people [4]. Value was actually created by the esoteric essence of “the Spirit of the Gift”, which holds the power to uplift and inspire others to make reciprocal gifts and new voluntary gifts [5].

The primary purpose and very real effect of such “gifts”, is actually “to establish a relationship”, by creating a moral “debt” of gratitude, inducing the instinctive desire to “reciprocate” the gift, thereby establishing a naturally self-perpetuating “exchange relationship” [6].

Accordingly, this most ancient system, indeed “Primordial”, appearing to arise in nature itself by Natural Law as God’s Law, can best be described as an “Economy of Relationships”.

In this “Primordial” Economy of Relationships, the “medium of exchange [was not] money, but rather… [a] sense of ‘I owe you one’…” as a Favour, to reciprocate for the Value of earned Merit, because “all human interaction is exchange… [of] ongoing relations… moral relations” [7] [8].

Therefore, the natural and original “Currency” of humanity as created by God, as the only real and true currency in Natural Law, in the universal “Economy” of the Kingdom of God, has always been Favours valued by Merit.

This is very different from the concept of modern “Money”, which is based on the destructive principle of “Artificial Scarcity”.

Rather, this primordial “Golden Age” economy was based upon the creative principle of “Abundance and Mutual Prosperity”, in which True Value comes from the living spirit and good will of humanity as created by God.

In this system, humans are co-creators of an unlimited and self-sustaining economy of the Kingdom of God, in which egalitarian communities were fully empowered to meet all needs of the people.

Money of Horses and Merits – After ca. 9,000 BC, with the domestication of cattle and working animals such as horses, livestock and “Service Horses” came to be used as the first tangible form of “Money” [9], as an objective quantifiable medium of exchange for Favours valued by Merit.

Later by ca. 3,200 BC in Mesopotamia, the natural currency of Favours of Merit, often valued by the equivalent of Service Horses, became “an elaborate system of ‘money of account’ and complex ‘credit’ systems” [10]. The earliest concept of “Money” was thus established as “Social Credit” of Favours, also considered “Moral Credit” of Merit.

Invention of Religious Coins – Ancient Coins originally developed during the Bronze Age ca. 1,850 BC in the Assyrian Empire, by traders stamping marks on valuable metals to certify their weight, only as commodities [11]. The first “Money” in the form of Coins, established in early Biblical times, was actually a “moral currency” of Religious Coins, created as the “Shekel of the Sanctuary” for spiritual offerings and tithings in the Temples of God (Exodus 30:11-16, 24; Exodus 38:24-26).

Invention of Secular Coins – The first Sovereign Coins were invented during the Iron Age ca. 560 BC in the Persian Empire, by Kings issuing “monetary currency” of Secular Coins as “Money”, stamped with an official seal to certify their weight or value as “legal currency” [12].

Two Separate Coin Systems – Jesus the Nazarene ca. 33 AD asserted an ancient doctrine of customary international law, mandating a Biblical “Separate Coins System” for the separate use of Religious Coins of moral value versus Secular Coins of monetary value: “Render unto Caesar the things which are Caesar’s; and unto God the things that are God’s” (Matthew 22:17-22; Mark 12:14-17; Luke 20:22-25).

The expulsion of the “money changers” from the “Temple of God” by Jesus (Matthew 21:12-17; Mark 11:15-19; Luke 19:45-48; John 2:13-16) was mostly because they were changing Roman Coins into Babylonian Secular Coins of the “Tyrian Shekel” from ca. 300 BC, instead of using the original Religious Coin of the “Shekel of the Sanctuary” (Exodus 30:12-16) [13] [14] [15].

Religious Primitive Money – Some indigenous cultures ca. 500 AD used “primitive money”, in the form of “objects from primitive societies, such as the stone… and seashells”. Stones used as money were “unique”, “imported”, and had “high esthetic value”, and thus were rare “semi-precious stones”, considered “entirely beyond price”, also holding great “religious value”. Rare shells used as money “also had a religious use… [the] necessity of using them in religious rituals provided an independent, and very powerful, source of demand”, giving them great “religious value”, which “guaranteed the shells’ value” as currency. [16]

Barter as Backup for Money – The “Barter System” of direct exchange of goods and services is often cited for independence from monetary currency. However, it still requires market-based commerce, different from a non-market Gift Economy or Favour System based upon Merit. Historically, Barter was mostly practiced from ca. 500 AD until ca. 1,500 AD, usually as a “backup” during financial crises when monetary currency was unstable or devalued.

The historical record reveals that the medieval Templar Order restored the ancient tradition of the “Separate Coins System”, by reviving the Biblical practice of Religious Coins, through issuing and using its own Templar Coins. This exercise of sovereignty applied Templar ancient sacred knowledge of the Pillars of Civilization to reclaim the role of the Kingdom of God in the economic system. These Templar Coins thus served to uphold human rights and freedoms, for the advancement of civilization, helping to lead humanity into the Renaissance, through Sovereign monetary strategies.

The historical record reveals that the medieval Templar Order restored the ancient tradition of the “Separate Coins System”, by reviving the Biblical practice of Religious Coins, through issuing and using its own Templar Coins. This exercise of sovereignty applied Templar ancient sacred knowledge of the Pillars of Civilization to reclaim the role of the Kingdom of God in the economic system. These Templar Coins thus served to uphold human rights and freedoms, for the advancement of civilization, helping to lead humanity into the Renaissance, through Sovereign monetary strategies.

Gold “Bezant” of the Kingdom Jerusalem, minted in Acre 1251 AD, 22 millimeters, average 3.33 grams, Arabic, in Richard A. Jourdan Collection

In the Chivalry of the Middle Ages from the 12th century, the minting and issuing of Sovereign Coins is proven to be an authentic practice of the Order of the Temple of Solomon, the historical institution of the Knights Templar, as an exercise of its sovereignty as a “non-territorial” (international) State having diplomatic status [17] [18].

The original “Crusader Coins” were the gold “Bezant” of the Kingdom of Jerusalem, created in 1124 AD [19], minted and issued exclusively by its High Court [20], at the same time when the Knights Templar actually became the High Court of the Kingdom during ca. 1120-1129 AD [21] [22]. Thus, the “Jerusalem Coins” were really “Templar Coins”. The Templar “Agnus Dei” (Lamb of God) seal used on many of the Jerusalem Coins [23], soon became the official Templar Grand Mastery Seal used in England (since 1160 AD) [24].

“Moneta” Copper Coins of Cyprus , later example minted ca. 1460 AD, artifacts in Paul Edis Collection

All of the other “Crusader Coins” were issued by the “Crusader States” of Edessa, Tripoli, Antioch, and Cyprus, which were sovereign Principalities of the Knights Templar [25]. Thus, these were essentially “Templar Coins” of “Templar States”, minted between 1129 AD and 1312 AD. Most of these “Moneta” Coins featured the Templar Cross-Paté, and were actually made of non-precious base metals, such as bronze, and copper for its Templar “rose” color [26].

Archaeology evidences that the Templar States issued mostly bronze or copper Templar Sovereign Coins, from 1124 AD. The historical record documents that these were primarily used for the internal non-market economy of the Templar Principalities, and for external affairs within Templar jurisdiction. Nonetheless, the Templar States continued to use Italian and French silver Coins, and Arabian gold Coins, as monetary currency for regional and international trade in commercial goods and services. [27]

The fact that these Templar Coins were indeed used as Religious Coins, different and separate from Secular Coins, was simply and clearly declared by the Coins bearing the Cross and other religious symbols, together with various religious inscriptions. This is abundantly evidenced by numerous Crusader Coins preserved in museums and numismatics collections around the world.

Historians confirm that in the Middle Ages, “Coins [were] good for their moral value… [to] aid in transactions between man and God via almsgiving [charitable donations]… the offering was a sacred act, a gift to God, with a special intention of gratitude or plea [prayer].” [28]

Merit Worth More Than Gold – Medieval Secular Coins were predominantly made of gold and silver. The fact that Templar Coins were made of non-precious base metals such as bronze and copper [29] [30], evidences that they are not a “monetary currency” of “monetary units” of fixed “monetary value”. Rather, this confirms that they are Religious Coins as a “moral currency” of “moral value” backed by earned Merit in Chivalry, in a Favour System among Templars with a network of Templar supporters.

The use of base metals is actually a bold declaration that Templar Merit Coins do not need any gold or silver for their True Value, which is literally “worth more than money”. It also avoids the distraction of people constantly wondering whether the Coins are “gold” or confusing these Religious Coins with mere monetary Secular Coins.

Minting these Religious Coins with base metals is also an expression of the Templar tradition of monastic modesty, refusing to glorify its Templar Coins by any form of “idolatry” of money. This is a very direct application of the Templar motto: “Non nobis Domine, sed nomini Tuo da gloriam”, meaning “Not to us, Lord, but to Thy name give the glory” (Psalm 115:1) [31].

Therefore, in a very real sense, the Templar practice of Religious Coins was a form of “Alchemy”, at least according to the classic popularized definition as “The medieval science… to transmute baser metals into gold” [32]. Medieval Templar Coins actually used base metals to transform them into Coins worth much more than gold, above and beyond any secular monetary value.

The Christian folk saying “The streets of Heaven are paved with gold” comes from the New Testament, describing Heaven as a “Holy City… coming down from God… every gate was of pearl: and the street of the city was pure gold” (Revelation 21:2, 21:21). From this came a classic favourite joke of the Templar Chaplains, which best expresses the concept of Templar Coins:

“A rich merchant near death begs the Angel to let him take just one suitcase of his worldly wealth with him. The Angel allows it, and the man fills the case with gold bars. When they get to Heaven, Saint Peter at the pearly gates inspects the suitcase, and says: ‘Oh, you brought – pavement ???!!!’”

Therefore, the Templars making Religious Coins with base metals is an excellent way to uphold the Templar principle that “Gold is worth nothing in the Kingdom of God”.

The Scriptures from King David ca. 1,000 BC place the highest value on “The Law of the Lord [God]… [and] judgments of the Lord… More to be desired are they than gold” (Psalm 19:7-10).

The Scriptures from King Solomon ca. 900 BC place the highest value on sacred knowledge from God: “How much better is it to get wisdom than gold! and to get understanding rather to be chosen than silver!” (Proverbs 16:16)

The Apostle Saint Peter (of the “pearly gates”) ca. 60 AD summarized both Scriptures in the New Testament, placing the highest value on being strong in one’s “Faith, being much more precious than gold” (I Peter 1:7).

Value of Earned Merit in Chivalry – Applying King David’s highest valuation of upholding the Laws of God as a way of life (Psalm 19:7-10), everything about Templar Chivalry was driven by the moral value of earned Merit, through service on the humanitarian missions of the Order.

The Temple Rule of 1129 AD commands to “serve in Chivalry” by “purification” through earned Merit (Rule 1), and to “apply pure diligence and firm perseverance… that… you will deserve to hold company among the martyrs” by earned Merit (Rule 2). It declares to “anyone who wishes to serve… you should not expect worldly gain so much as the eternal salvation of their souls”, confirming that the primary Templar currency is earned Merit (Rule 12).

The Temple Rule requires to always “set an example of good works and wisdom” in society through demonstrated Merit, so that others will “be bestowed with honour” (Rule 37). It strictly prohibits “to promote oneself gradually and become proud”, which would be a rejection and defiance of the Templar values of earned Merit (Rule 46). It describes living by the Templar Code as having “double Merit and special virtue” (Rule 57). [33]

The Templar Patron Saint Bernard ca. 1136 AD emphasized the moral value of earned Merit in the Templar Order: “There is no distinction of persons among them, and deference is shown to Merit rather than to noble blood.” [34]

Saint Bernard specifically explained the supreme Value of Merit in the Templar Order: “Their quarters indeed are in the very Temple of Jerusalem… Truly all the magnificence of the first Temple lay in perishable gold and silver… whereas all the beauty… of [this Temple] is the religious fervor of its occupants and by their well-disciplined behavior. In [this Temple]… one is able to venerate all sorts of virtues and good works. … One is able to delight there in splendid Merits rather than in shining marble, and to be captivated by pure hearts rather than by gilded paneling.” [35]

The Templar Order revived the Merovingian tradition from the 6th to 8th centuries that Titles of Nobility were not only hereditary, but also earned by serving in public office [36], such that “one could also acquire nobility” by Merit of public service [37].

The Templars promoted in the 13th century that nobility could also be acquired “by Royal grant” of Letters Patent for demonstrated earned Merit [38]. This distinctly Templar tradition gained even more popularity later throughout the Renaissance (16th–18th centuries) [39].

Confirming that the Templar concept of nobility is solely based upon the value of earned Merit, “one could lose nobility, by failing at one’s feudal duties (‘déchéance’) or practicing forbidden occupations (‘dérogeance’).” [40]

Merit Value of Intellectual Property – Applying King Solomon’s highest valuation of preserving sacred knowledge and wisdom (Proverbs 16:16), the greatest asset of the Templar Order is its intellectual property base of 12,000 years of sacred knowledge of the Pillars of Civilization. Accordingly, the primary economic Value of earned Merit in the Order is driven by its continual restoration and effective use of that knowledge.

The Temple Rule of 1129 AD commands that the Templar knowledge base must be “guarded purely and durably” (Rule 2), and “must not be forgotten, and… must be guarded firmly” (Rule 8), requiring Templars to “study universally” (Rule 9), as an essential part of earning Merit [41].

Because the Templar Order always does this actively and effectively, the Vatican Papal Bull Omne Datum Optimum of 1139 AD specifically recognized the Templar Order as a “university institution [universitetem exortamur]” [42].

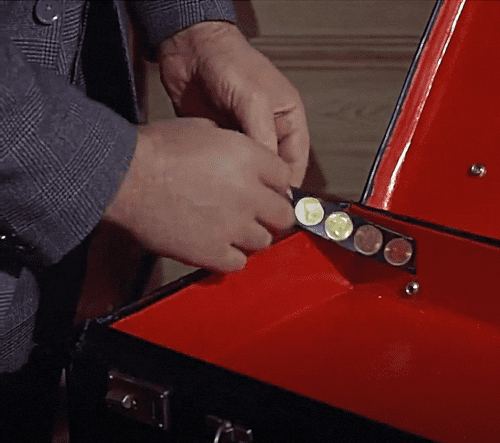

James Bond “From Russia with Love” film (1963), scene at 0:22 hour, “Q” showing attache case concealing 50 Gold Sovereigns

In this film, the master of spy gadgets “Q” gives James Bond a special attaché case with hidden knives, tubes of bullets, and other gadgets, and says: “Then if you pull out these straps, inside are 50 gold sovereigns, 25 in either side” (at 0:22 hour).

These Gold Coins were mounted on leather straps hidden under the lining, each with one end disguised as a strap holder for the case lid.

This demonstrates how Gold Coins were intended to be used as a universal currency for payments “outside the system”, such as requesting special Favours or exclusive services. This is an expression of the basic human understanding, as a premise, that such Coins are widely recognized as something more desirable, and more compelling, than the large amounts of paper money which James Bond also carried.

This depiction illustrates the Archetypal intuitive and psychological power of special Coins, by their unique ability to represent something more important, and more valuable, than mere “Money”.

The British Sovereign is 7.98 grams of 22 carat gold, 22 millimeters wide and 1.5 millimeters thick. Although these are nominally (symbolically) denominated as “One British Pound”, their actual monetary value is the current price of gold.

James Bond “From Russia with Love” film (1963), scene at 1:33 hours, Gold Sovereigns used as a distraction

A gold Sovereign is usually worth about $400 USD (325 GBP), so each of James Bond’s strips of 25 Coins were worth about $10,000, and both strips in the case totaled about $20,000 USD.

Later in the film, when cornered at gunpoint by a “Spectre” Agent, James Bond jokingly offers him the Gold Coins as a bribe, but really as a distraction. This attracts the Agent’s interest enough to open Q’s booby-trapped briefcase looking for more, which blasts him with tear gas, allowing James to escape with all the Gold Coins – and of course, with the girl (at 1:33).

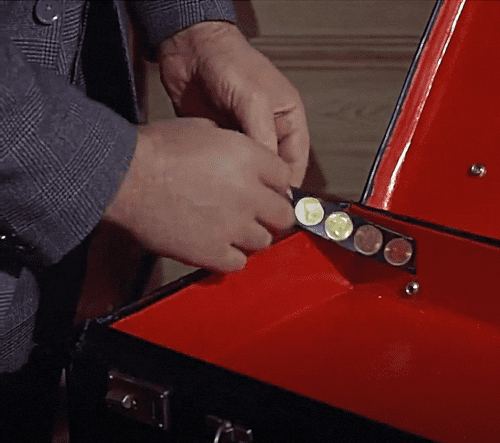

“John Wick 1” film (2014), scene at 0:26 hour, secret stash with Coins and Guns

In the first film “Chapter 1” (2014): John Wick digs up his secret stash of “Gold Coins” and guns, preparing for war against the Russian mafia (at 0:26 hour). After killing 12 bad-guys who attack his home, he pays the clean-up and disposal crew with 12 Coins (at 0:34). He then checks into the exclusive Hotel “Continental” in New York with one Coin (at 0:39), and visits the exclusive bar lounge, entering a secret door unlocked by one Coin (at 0:40). The lady Perkins later kills a man and takes off him the Coin which John Wick gave him to watch her (at 1:04).

In the second film “Chapter 2” (2017): John Wick buries his secret stash of Coins (at 0:18 hour). He is soon presented with a “Marker” (a large special Coin which opens as a locket) requiring a serious Favour (at 0:21). The Continental owner inspects a batch of newly minted Coins, and says “Put these into circulation” (at 0:27). Accepting the mission to fulfill the Marker, John visits a private safekeeping vault and retrieves a suitcase, opening its false bottom revealing another secret stash of Coins and guns (at 0:35);

He then checks into the Continental in Rome with one Coin (at 0:36), where he enters a secret “tailor” shop by one Coin (at 0:38), obtains a secret map and antique keys paying 4 Coins (at 0:41), and purchases weapons and suits with bullet-proof lining. At the bar his colleague buys their drinks with one Coin (at 1:07). When he completes the mission, the Continental requires the holder to “mark the Marker” (inside the locket) as being fulfilled (at 1:14);

“John Wick 1” film (2014), scene at 0:34 hour, payment of the clean-up service

When John Wick needs sanctuary from a group of assassins hunting him, he gives one Coin to an Agent of an independent organization, disguised as a “homeless” person watching the streets, to hide him and take him to safety (at 1:23).

When John Wick violates an important rule of the Code of Conduct, the owner of the Continental regretfully tells him: “You leave me no choice but to declare you ‘Excommunicato’ – The doors to any service or provider in connection with the Continental are now closed to you.” (at 1:50). He is given one hour before this takes effect, rendering all Coins useless to him, as nobody in the society could accept Coins from him.

In the third film “Chapter 3” (2019): John Wick gives a Coin to a New York taxi driver to take his dog to safety with the concierge of the Continental (at 0:04 hour). He then retrieves a secret stash hidden in an antique library book, including 5 Coins, a Marker for a major Favour owed to him, and unique Rosary beads (at 0:06). He uses one Coin for a private doctor to repair his knife wound (at 0:09), just moments before his “Excommunicato” takes effect.

Now unable to use the Coins, he shows the distinctive Rosary to enter a ballet theater for sanctuary (at 0:24), and then uses it as a Marker, saying “I still have my ticket” (at 0:26), which he gives for safe passage to Morocco (at 0:30). He has thus switched to an alternative Favour System of a different society.

The lady “Adjudicator” (Judge) for the “High Table” council checks in to the Continental, giving a larger special Coin which appears to be bronze (at 0:32), and seems to be only presented but not given, as in one scene she takes it back (at 0:47). This type of Coin appears to be used more as an official badge, signaling that all those presented with it already and automatically owe her unlimited Favours, as a practical result of her high position of power and authority, and their allegiance to the High Table.

“John Wick 1” film (2014), scene at 0:40 hour, entering the secret door with a Coin

When John Wick reaches the founding base of the High Table in Morocco, the Coin is explained to him: “This Coin, of course, does not represent monetary value: It represents the ‘Commerce of Relationships’. A ‘Social Contract’, in which you agree to partake – [in] Order and Rules.” (at 0:52).

These films never say that the Coins are supposed to be “Gold”, despite that assumption which is only implied by their appearance.

Rather, the film shows the Coins used for goods and services of both much lower and much higher value than their weight in gold. This indicates that the Coins are disconnected from any fixed monetary value, and thus are not made of gold, but could be a non-precious metal such as brass.

One notable aspect of the John Wick Coins culture, is that the Coins are always offered when making a request, and given “up-front” in advance, never waiting until after a service is completed. This illustrates an “Honour System” under a “Code of Honour”, by which the voluntary acceptance of an offered Coin creates a binding contract, under a strict obligation to perform the agreed service.

Note that as illustrated in the John Wick films, there is no possible scenario where any of the characters wants or needs to “cash out” their Continental Coins for mainstream monetary currency. Rather, they always keep them in secret stashes, even when they are “retired”, because of the supreme and priceless value of the Favours which they may need in the future.

As a point of mere curiosity, the John Wick Coins feature the following Latin inscriptions: “Ens Causa Sui”, meaning “Being Caused by Itself” (front), and “Ex Unitae Vires”, meaning “From Unity is Power” (back). The Adjudicator’s large special Bronze Coin bears the inscription “Actiones Secundum Fidei”, meaning “Actions According to Faith”.

“John Wick 3” film (2019), scene at 0:04 hour, a Coin for a taxi driver to take the dog to safety

A private economy of any illegal secret organization (real or fictitious), to be practical, would need to be based on some alternative substitute for sovereignty, which would probably have to be some threat and use of unlawful armed force.

However, a public institution of legitimate sovereignty of Statehood can much better implement such a Coin based economy, governed and enforced by the Rule of Law, under customary international law as Common Law.

This is an excellent way for an historical State to lawfully operate exclusively within its own sovereign “non-territorial” (international) jurisdiction, remaining exempt from country jurisdictions of politically corrupt modern governments.

Many economists have analyzed private “dark-money” and “black-market” economies, based upon historical elements of public Sovereign Coin economies, some with reference to the “John Wick Economy” [43] [44]. Such analyses reveal the following underlying principles for an effective Coin based economy:

Most simple services, such as one-time tasks, or providing consumable goods or durable working tools, cost one Coin per instance, regardless of any monetary cost value. This indicates that among a community of skilled professionals, all work is treated as morally valued equally. It also means that the Coin really represents a Favour, and a reward for earned Merit.

However, complex services such as a project or mission, involving numerous tasks over an extended time period with substantial costs, do not use the Coins, but instead require a “Marker”, a higher level personal Bond instrument for the most rare and exclusive services which are considered especially “priceless”.

“John Wick 3” film (2019), scene at 0:06 hour, secret stash with Coins hidden in the public library

The Coins represent a private exchange of a Favour, and also represent the “Code of Conduct” which governs the transactions. Thus, the actual monetary value of the physical Coin is irrelevant, and can even be minimal, while still upholding its full moral and transactional value. Accordingly, the Coin is not a “monetary unit” of cost value, and thus not a “monetary currency”, but rather a “moral currency” of a Favour System.

The value and use of the Coins is driven by the Sovereign institution (in the John Wick film, a hotel called the “Continental” under the “High Table” council), serving as the central or primary source for providing, and a network unifying or facilitating access to, most services. As a result, it functions as a form of “central bank”, by putting the Coins into circulation.

Most of the value of the Coins is actually not the cost of goods or services, but rather consists of the security of working outside the mainstream system, within a sovereign system driven by Rules and a Code of timeless principles.

The issuing Sovereign institution profits from “seignorage” of the minting and selling of the Coins. As the institution cannot make use of unlimited goods and services of the collective of its members, the Coins must be initially purchased with mainstream monetary currency. This capitalizes the institution, empowering it to operate and assert its influence in the outside world, on behalf of all members.

Unlike with modern monetary “Fiat money” currency, minting new Coins based upon purchasing them never dilutes their value, as they are always backed by the added value of capitalization of the institution, which in turn drives the added value of benefits of its exclusive sovereign economy.

“John Wick 3” film (2019), scene at 0:09 hour, a Coin at the secret door for the private medical doctor

The institution “guarantees” (or at least effectively provides) enforcement of the Rules and Code which give the majority of value to the exclusive level of goods and services in its sovereign economy. It is thus in a position to require everyone dealing within its sphere of influence to utilize its Coins.

Issuing and using Coins gives the Sovereign institution the advantage of currency control, while generally avoiding the need for reporting, by requiring direct presentment of the Coins (whether physical or digital). To “cash out”, by exchanging one’s Coins for mainstream monetary currency, one must deliver the Coins to the issuing institution.

As a result, if any taxation would be practiced, there would be no need for any reporting of activities or revenues, as the tax could be assessed from the presented Coins alone. Additionally, there is no need for any taxation of revenues, because the institution can simply charge fees only for “buying in” and “cashing out” of the Coin economy.

The total capitalization of the Sovereign institution primarily consists of the purchase funds of the total amount of Coins currently in circulation. As the institution spends its capital on costs of operations, the capitalization fund is replenished by revenues generated by that same use of capital funds, and by revenues of fees from new “buying in” purchases of Coins, supported by offset of fees from “cashing out” of Coins.

Following the ancient practice of Biblical “tithing”, the issuing institution could add 10% of the purchase cost when “buying in”, and discount 10% of the equivalent monetary value of the sale when “cashing out”. Meanwhile, all activities and transactions within the Coin system could be non-reportable and non-taxable, making the sovereign economy itself a “tax haven”.

“An Angel grants a man the opportunity to meet God and ask three questions. He asks: ‘To you, God, what is a million years?’ God answers: ‘It’s a minute’. ‘To you, God, what is a million dollars?’ ‘It’s a penny’. So the man thinks, and asks: ‘God, will you give me a penny?’ God says: ‘Sure, in a minute!’”

In the science of economics, there are only two types of “value” for a currency: A “nominal value” is fixed by decree (“fiat”) declaring an equivalent monetary amount, which requires continual adjustment for inflation, devaluation and currency exchange rates; The “Real Value” is measured by real-world purchasing power of tangible goods, which proportionally remain constant over time. [45]

Thus, following the folk wisdom of Oscar Wilde, “nominal value” means knowing the “Price” of a monetary currency, but “Real Value” means knowing the true “Value” of real benefits of a moral currency based on Merit.

Economic Value of Templar Coins – Templar Sovereign Coins represent the ancient Religious Coin system, upholding the highest form of Real Value in the Kingdom of God. Accordingly, the Templar Order must reject and avoid having any declared “nominal value” of its currency, and must preserve the original historical basis for the Real Value of its Templar Coins.

The world’s oldest currency still in continuous use since its inception is the “Pound Sterling” of England, established by King Henry II in 1158 AD, originally valued at one pound weight of silver. The British “Gold Sovereign” was established in 1817 AD with a “nominal value” of “One Pound Sterling”, the monetary value of which changed dramatically from inflation and devaluation, in contrast with increase in the price of gold.

In England of 1270 AD, One Pound Sterling could purchase “One Horse”, and in 2017 AD is equivalent to about £815 GBP, which is $1,000 USD [46] [47]. In 2020 AD, more than 55% of horses can still be purchased at an average cost of $1,000, for a “quarter horse” or “working horse” (i.e. not a thoroughbred or racehorse) from 5-10 years old [48].

The original British “Pound Sterling” Coin of the Middle Ages is direct historical evidence of the transactional Value of the same type of iconic medieval Sovereign Coins as issued by the Templar Order. Thus, the economic Real Value of authentic Templar Coins is the same purchasing power of the Pound Sterling Coin of 1158 AD, by its earliest recorded valuation in 1270 AD.

Accordingly, the timeless and perpetual Real Value of Templar Merit Coins, as proven by the historical record, is actually “One Horse”, which in turn can then be measured indirectly, by the modern equivalent monetary cost of purchasing that horse. As a result, the practical Value of Templar Coins can be translated in the context of modern currency (as of 2020) as $1,000 USD, because that is the purchasing power of “One Horse”.

Therefore, the economic “Real Value” of each Merit Coin, as its timeless purchasing power, is that of “One Service Horse” as a living creature of God, which is indirectly equivalent to $1,000 USD in modern times.

The Value of a Horse as a living creature is a time-tested Truth, which transcends all market-based commerce, and throughout human history has never changed, and never will. A Horse gives True Value not only of its utility of service, but also its loyalty and bravery, companionship, and even friendship.

Real Value of Merit as “Horse Power” – It is highly appropriate that the most provable Real Value of Templar Coins, which could best be established from evidence in the historical record, is that of “One Horse”. This means that the True Value of Merit of Templar Coins in a Favour System of Chivalry, is literally driven by “Horse Power”(!).

‘Pet Portrait Painting of a Horse’ (C) 2020 by Oil Pixel Art (India) Restricted Educational ‘Fair Use’

Indeed, the Old English word “Chivalry” (ca. 1300 AD) comes from the Old French words “Cheval” meaning “Horse”, and “Chevalerie” meaning “Horsemanship” (ca. 750 AD). Those come from the Classical Latin word “Caballus” (ca. 250 BC), meaning specifically a “Work Horse” as a service animal. [49] For this reason, the Chess Piece for the Knight is a Horse.

Such a perfect match of Templar Coins with the Real Value of a “Service Horse” can be expected with such a Religious Coin currency. This is yet another example (among many) of how the Holy Spirit works strongly in the Templar Order, reassembling the fragmented pieces of “lost” history scattered across many millennia to restore the sacred knowledge, in a way which clearly exceeds any capacity of human planning.

This recalls another classic favourite joke of the Templar Chaplains: “If you want to make God laugh – tell him your ‘plans’!”

It seems profoundly morally satisfying that Templar Merit Coins, which represent the highest form of True Value in the Kingdom of God, can only be valued in this world by the measure of the living being of a Horse, as one of God’s Creatures. The 13th century Saint Francis of Assisi, famous for ministering to the animals, would surely be pleased.

This concept, of the True Value of Merit being backed by the Real Value of a living Horse, is a perfect example and illustration of why Religious Coins are spiritual moral currency and not secular monetary currency:

A Templar Merit Coin would not be given for mere goods and services which are generally for sale at standard commercial prices. Secular “Money” is already effective for that routine purpose. However, exclusive services or special acts of assistance, which one would only grant to close friends and family, are personal Favours which are universally considered “priceless”.

For such rare benefits, governmental “Money” would be wholly inadequate, and offering it could even be insulting, while accepting it would disregard the Merit and disrespect the True Value of the benefit provided. Therefore, in such cases of special Favours which are “priceless”, only Templar Coins can be used.

Therefore, the practical True Value of each Merit Coin is “priceless”, opening the door to private access to exclusive services not offered to the general public nor in commerce, or special help or privileges which are personal Favours. They are thus literally “worth more than money”, allowing asset protection and giving freedom to operate “outside the system” in a non-monetary economy.

Measure of the Range of Favours – The concept of “One Horse” as the economic Real Value of a Merit Coin in a Favour System, provides a very useful intuitive measurement, expressing the range of scope and magnitude of the Favour for which it is exchanged. This provides a moral and practical understanding of which type and degree of Favours may be requested or rewarded, in relation to an appropriate number of Coins:

Essentially, one Merit Coin valued as “One Horse”, would effectively request or reward a Favour of such character, that a Knight or Dame in the Middle Ages would feel compelled by gratitude to reciprocate by making a gift of a Horse.

To understand this in historical context, the Temple Rule of 1129 AD provided that “Each Templar Knight may have Three Horses” (Rule 51), such that one would not be gifting one’s only Horse which one rode in on. [50]

“Kingdom of Heaven” Film Example – The film “Kingdom of Heaven” (2005) starring Orlando Bloom, perhaps best illustrates the Value of a Horse, representing a medium of exchange of personal Favours based on Merit, and conveys an intuitive feeling of the range and type of such Favours.

‘Kingdom of Heaven’ (2005), scene at 2:54 hours, reciprocal Gift of a Horse for Merit and Favours

A Templar Knight lost in the desert kills one Saracen who challenged him to take his Horse, and spares the life of the second Saracen. When the Saracen takes him to Jerusalem, and comments “A very good Horse”, the Knight says “Take the Horse, and be about your business”. The Saracen replies “This is your prize for battle, I am your prisoner”, but the Knight insists, and sets him free with the Horse as a gift. The Saracen says: “Your quality will be known among your enemies, before ever you meet them, my friend.” (at 0:46 hour)

When the Knight is later captured in battle, his life is spared by that same Saracen, who was actually a high-ranking General (at 1:29). When Salahadin grants safe passage for the Christians to relocate to Cyprus, the Saracen General visits the Knight to say goodbye. To gift the Horse back to the Knight, while avoiding any implication of moral debt, he says with a warm smile: “This horse, is not a very good horse, I will not keep it. … Peace be upon you.” (at 2:54)

This portrays the gift of a Horse, both representing and recognizing Merit, in a Favour System of Chivalry, even between potential enemies, sharing in a higher True Value of the Kingdom of God, resulting in peace-making.

As the moral currency of a Favour System in Chivalry, each Merit Coin is redeemable for one Favour requested, on the basis of representing one’s earned Merit for deserving that Favour. Alternately, each Coin is given to reward one Favour received, on the basis of expressing one’s gratitude for another’s earned Merit by having given that Favour.

Asset Protection Not “Investment” – Templar Merit Coins are not designed to be an “investment”, because there are no fluctuations of monetary currency nor precious metals nor exchange rates, and thus no mechanisms for speculation seeking profits.

Rather, Merit Coins are designed to serve as “asset protection”, providing stability by upholding Real Value, backed by the most real and true Value of Merit which is timeless.

As a result, Templar Coins serve as an economic “store of value”, by converting one’s material wealth from the corrupt and unstable governmental monetary system, into the primordial Golden Age system of the spiritual economy of the Kingdom of God.

By transforming secular monetary value into religious moral value, embodied in a Sovereign Coin system, assets are placed entirely outside the jurisdiction of all modern countries, thus wholly exempt from regulation and taxation, with legal immunity from confiscation.

Coins Earned by Merit as Backing – Each and every Templar Merit Coin, as and when issued, is inherently solidly backed by the True Value of earned Merit upholding its economic Real Value.

Illustration of Military Officer receiving a Medal for earned Merit, photo by Reuters (Detail)

Members of the Templar Order can earn Merit Coins directly, through volunteer work as service in Chivalry on Templar projects and missions. For various volunteer efforts and accomplishments which advance the capabilities and success of the Order on humanitarian missions, it can reward volunteers with Templar Coins inherently backed by their contributed Value of Merit.

By this ancient Golden Age system, the issuance of new Merit Coins never dilutes their valuation, and further drives the benefits of the Templar economy as a Favour System in Chivalry.

Merit Coins can also be issued based upon accomplishments of the Templar Order itself as an institution, generating its own Merit backing through ongoing collective milestone achievements which strengthen the capabilities and influence of the Order in the world. Resulting Merit Coins can then be given as No-Interest Loans to members, to stimulate the Favour System economy.

Even the Templar version of the traditional “buying in” to a currency of Sovereign Coins is still truly earned, by a genuine form of demonstrated Merit:

Templar Coins are not directly “purchased”, but rather earned by giving charitable Donations to the Templar Order. This is authentic and effective, because the Sovereign issuing institution is an Order of Chivalry, which uses all available funds for its real-world humanitarian missions upholding the Pillars of Civilization. Sponsoring Merit is a legitimate form of earning Merit;

Earning Templar Coins through giving Donations meaningfully contributes additional Value of Merit, through capitalization of the Order, empowering it to actively conduct more missions for humanity, and to generate more of its own revenues. This added Value of earned Merit thus directly provides the new “backing” justifying the issuance of the corresponding Merit Coins.

Practical Uses of Templar Coins – The Templar Order is the issuer of its own currency of Merit Coins, because it is an Order of Chivalry, as the central unifying institution for its international network of Templars. It is thus the primary source of its own active humanitarian missions, through which demonstrated Merit earns its Templar Coins. Accordingly, the Order both provides and facilitates a wide range of exclusive non-commercial services, covering a wide range of professions.

Beyond its own substantial capabilities, the Templar Order has access to an expanded network of affiliates through its diplomatic relations, including inter-governmental organization (IGO) institutions. This provides direct access to rare and high-level services, of powerful utility and great benefit, from affiliated institutions who continually owe enormous Favours to the Templar Order for its support as Defenders of their Sovereignty.

These institutional resources, both internal and external, create numerous and diverse practical uses of Templar Merit Coins, to open the doors for unique expert services of governmental caliber, which cannot be available to the general public, and cannot be provided on a commercial basis.

Use by Non-Member Supporters – Templar Merit Coins are not limited to use only by members of the Order. They can also be used to engage, reward and benefit supporters, participating in a larger community based upon Templar Chivalry. Economists note that this special type of “Community currencies… allow [government] authorities… to explicitly value, and thereby incentivize, the contribution of the general public to their [State] services.” [51]

Supporters who are non-members can earn Merit Coins by providing Favours assisting individual Templar members, who can personally reward such supporters with their own earned Coins. Supporters can also earn Merit Coins by giving substantial Donations directly to the Templar Order, which is a Favour to the Order as an institution.

Therefore, it is not required to be a member of the Order to earn Merit Coins independently, thereby earning access to an expanded network of Templars and supporters in an international Favour System in Chivalry.

When a supporter presents a Merit Coin to a Templar, the Order, or an affiliated institution, this has profound significance: Although the supporter is not a member, and nobody may know them nor have heard of them, everybody will know that the supporter has earned real Merit by giving a Favour in the Templar network, and thus deserves a special Favour in return.

Converting Templar Coins – Economists explain that part of the “backing” or “valuation” of an independent alternative currency is that it “can be converted… as a last resort with the issuing organization”, which will “guarantee the currency by… accept[ing] it as payment for goods or services in the system” of the institution [52].

One modern precedent is the “Zeitvorsoge” community currency of volunteer “time credits” of the City of Saint Gallen, Switzerland, evidencing that such “guarantee” does not require actually converting to monetary currency:

“The city itself acts as guarantor, ensuring that credits can be redeemed… for similar [volunteer] services if and when the earner requires them, either through the [affiliated] organizations or peer-to-peer. This puts people in charge… allowing them to define and meet their own needs… with the professional and financial support of public institutions.” [53]

Other precedents of successful community currencies evidence that converting back to monetary currency can be limited to specific scenarios of practical necessity: One allowed only those who purchased the credits to change back to standard money; Another allowed only businesses to exchange the credits for standard money. [54]

The Temple Rule of 1129 AD authorizes those in the “communal life to receive tithes… in charity” (Rule 58) [55], such that the Order can give Grants to those who participate in the Favour System of the Templar life of Chivalry. Accordingly, just as Templar Merit Coins can be earned by giving charitable Donations to the Order, they can also be converted by exchanging for the Favour of the Order giving a reciprocal Grant for humanitarian activities.

Therefore, the most authentic and effective policy for the Templar Order is to allow converting Merit Coins by applying for a “Merit Grant”, which can be approved when: (1) The Coin holder has previously given direct monetary Donations to the Order to earn such Coins; or (2) The Grant will sponsor active humanitarian projects of the Coin holder.

Traditional Service Fee for Coins – As Templar Sovereign Coins are a Religious Coin of moral currency for exchange of Value of Merit, they are analogous to the Templar “Travelers Cheques”, but used only for exchanging “priceless” Merit in a Favour System of Chivalry.

Accordingly, for issuing and for converting earned Merit Coins, it is authentic for the Templar Order to charge the same “handling fee” as it historically did for Travelers Cheques [56], which was the traditional Service Fee of “ten percent [10%]” (as a Biblical “tithing”) for such transactions [57] [58].

One modern precedent of a successful community currency, which charged the same traditional Service Fee of 10%, evidenced that this did not interfere with its effectively gaining in popularity and expanding its influence [59].

The Service Fee was never intended as any form of “profit”, but rather creates a form of self-insurance fund of “Monetary Reserves”, for the Templar Order to maintain availability of liquidity for necessary conversion cases. This way, every qualified case needing monetary conversion of one Coin, would be covered by 10 Service Fees from other Coins being issued or converted.

The Service Fee, when converting Merit Coins into a Grant in monetary currency, also serves as some degree of a disincentive to convert Coins, and an incentive to network with Templar members and supporters to use the Coins for much greater benefits, which are “worth more than money”.

However, with Templar Merit Coins as moral currency in a Favour System of Chivalry, the Templar Order cannot require an individual to perform a personal Favour which is unique and “priceless”, which one finds unconscionable, or which would cause one damages and hardship. This is recognized in a fundamental doctrine of Common Law:

“[A Court of] Equity will not… compel specific performance of [a service] of an essentially personal character”, and “specific performance will not be decreed if it would [be]… contrary to good conscience… nor where it would work hardship” [61].

Accordingly, if one would incur significant monetary costs to perform a requested Favour, and one does not have sufficient monetary funds to do so, then one may invoke the “Separate Coin Systems” doctrine: It is acceptable to require that Secular Coin be paid only to cover basic real monetary costs, while the Templar Merit Coin is accepted only for the separate aspect of one’s own personal skilled efforts in performing the Favour.

Nevertheless, everyone participating in the Templar Favour System does have an obligation to accept Templar Merit Coins for any request which is honourable, reasonable, and practicable, and is within one’s range of competence and capabilities:

The Code of Chivalry of 1066 AD commands “Thou shalt perform scrupulously thy feudal duties, if they be not contrary to the laws of God” (7th Pillar), such as by accepting the Coins of the realm for any proper request; “Thou shalt remain faithful to thy pledged word”, which is “synonymous with honour” (8th Pillar), and thus “be reliable for friend or foe”, such as by upholding the Favour System as an economy of Merit; “Thou shalt be generous, and give largesse to everyone” (9th Pillar), such as by granting a Favour to help a colleague. [62]

The Temple Rule of 1129 AD mandates that Templars “must give your lives” to rescue, protect and defend one’s fellow Templars (Rule 56, Rule 63) [63]. Thus, Templar Merit Coins must be accepted for those who need sanctuary, safe haven, safe harbour, or safe passage, insofar as one is able to provide.

Therefore, any refusal of a proper request for a Favour which one could and should provide, which appears to be either a denial of the Value of Merit Coins, or a rejection of the Favour System, would be a violation of the Templar Code. For such an offense, one should be disqualified from participating in the Favour System of Merit in Chivalry.

The only practical and effective way to implement or enforce such disqualification, is for the Templar Order to excommunicate the person who wrongfully refuses to accept a Merit Coin:

If one has rejected the Value of Merit itself, in essence one has devalued and lost all Merit of oneself, thereby no longer deserving any Favour. In such case, it seems fitting that all Merit Coins in one’s possession would become useless in one’s hands, because nobody in the Templar Favour System network could accept any Coins from one who is excommunicated.

Under the Code of Canon Law, rejecting Merit Coins would be “Heresy” as “denial… of a Truth which must be believed”, or “Schism” as “withdrawal… from communion with the members” (Canon 751), incurring mandatory automatic excommunication (Canon 1364, §1) [64].

Although the Templar Order is authentically inclusive of diverse beliefs, and thus applies no rules on “Heresy of Faith”, refusing a Merit Coin would actually be a “Heresy of Chivalry”: In an Order of Chivalry, certainly the True Value of Merit is a “Truth which must be believed”, or else Chivalry itself could not exist; Refusing a Merit Coin is both a “denial” of Merit and Chivalry, thus “Heresy”, and also a “withdrawal” from the Favour System, thus “Schism”.

While the Temple Rule forbids to “take any things” from an “excommunicated person”, it is “well permitted to receive one’s things for charity” (Rule 13). Thus, Merit Coins from one who is excommunicated can still be accepted as Donations to the Order.

Under the Code of Canon Law, such Donations can be credited as “Penance” (Canons 1342, §1; 1357, §1) towards lifting excommunication by “Absolution” (Canon 508, §1) for “Repentance” and “Reparation” (Canon 1347, §2), to restore one’s Merit and participation in the Favour System [65].

The Temple Rule of 1129 AD requires mandatory expulsion for “Theft, which is understood in various manners” (Rule 227), and suspension for “Causing loss to the Order… because all damages are forbidden” (Rule 260) [67].

Under the Code of Canon Law, any forgery of a counterfeit Coin thereby “composes or uses a false public document” (Canon 1391), also constituting “usurpation” of sovereign minting authority (Canon 1381), with expanded public impact (Canon 837, §1), requiring “excommunication” (Canon 1388, §2) as a “just penalty” (Canon 1399).

This excommunication would be as “Anathema” (Galatians 1:9; I Corinthians 16:22), with the offender ceremonially “delivered unto Satan” (I Timothy 1:20; I Corinthians 5:5). This leaves no possibility of rehabilitation by penance, although “the penalty [of] penance may be added” and enforced as monetary punitive damages (Canon 1326, §2; Canon 1357, §1). [68]

“Recoinage… [is] one weapon against the threats of forgery”, traditionally “known as ‘renovatio monetae’ (renewal of the coinage), a system in which… they had to be reminted from time to time” [69]. Declaring this as a policy served as an effective deterrent, because forgery thus carried the risk of counterfeits being detected soon enough to be investigated.

Many medieval kingdoms would conduct recoinage periodically “at regular intervals”, thereby filtering out counterfeits which could not be exchanged, while also generating some revenues from conversion fees. However, “there was a tangible disinclination [reluctance] to alter a familiar and successful coinage” which had gained popularity. [70]

The Templar Order has a more practical and cost-effective method of deterring, detecting and prosecuting counterfeits of its Sovereign Coins: Templar Merit Coins are minted with a secret chemical element blended into the metal alloy, which is not detectible by any metallurgical technology. However, it is easily detectible by chemical surface testing, only if one knows what to test for.

Learn about Templar Banking Principles of the Order.

[1] David J. Cheal, The Gift Economy, Routledge, New York (1988), pp.1-19.

[2] R. Kranton, Reciprocal Exchange: A Self-Sustaining System, Journal: “American Economic Review”, Volume 86, Issue 4 (September 1996), pp.830-851.

[3] Jonathan Parry & Maurice Bloch, Money and the Morality of Exchange, Cambridge University Press (1989), “Introduction”, pp.8-12; Parry & Bloch are Professors at the London School of Economics and Political Science.

[4] Chris Hann & Keith Hart, Economic Anthropology: History, Ethnography, Critique, 1st Edition, Polity Press, Cambridge, UK (2011), p.50.

[5] Jonathan Parry, The Gift, the Indian Gift and the ‘Indian Gift’, Journal: “Man”, Royal Anthropological Institute of Great Britain and Ireland, Volume 21, Issue No. 3 (September 1986), at pp.466-469.

[6] Chris Gregory, Gifts and Commodities, Academic Press, London (1982), pp.189-194.

[7] David Graeber, Debt: The First 5,000 Years, Melville House, New York (2011); “Chapter 3: Primordial Debts”; Graeber is a Reader of Social Anthropology at Goldsmiths University London, and Associate Professor of Anthropology at Yale University.

[8] Yves Smith, What is Debt? An Interview with Economic Anthropologist David Graeber, “Naked Capitalism” Magazine (26 August 2011); Interview conducted by Philip Pilkington.

[9] Roy Davies & Glyn Davies, A Comparative Chronology of Money: Monetary History (2005); Summary from: Glyn Davies, A History of Money from Ancient Times, 4th Edition, University of Wales Press, Cardiff (1996), p.716.

[10] Yves Smith, What is Debt? An Interview with Economic Anthropologist David Graeber, “Naked Capitalism” Magazine (26 August 2011); Interview conducted by Philip Pilkington.

[11] Encyclopaedia Britannica, “Coins of Asia: Ancient Persia”, Section: “Achaemenids” (Britannica Online).

[12] Coins of the Ancient World, Detroit Institute of Arts (1964).

[13] Bennet Bronson, Cash, Cannon and Cowrie Shells: The Non-modern Moneys of the World, Journal: “Bulletin”, Field Museum of Natural History, Chicago, Volume 47, Issue 10, pp.3-15.

[14] Donald J. Wiseman, Illustrations from Biblical Archaeology, Tyndale Press, London (1958), pp.87-89.

[15] Prof. James F. McGrath, Jesus and the Money Changers, Journal: “Bible Odyssey”, Society of Biblical Literature, Butler University, Indiana (2014); “The money changers were there to convert various currencies into… the Tyrian Shekel that was used”.

[16] Dr. Dror Goldberg, Famous Myths of ‘Fiat Money’, Project Muse, Journal of Money, Credit and Banking, The Ohio State University Press, Volume 37, Number 5 (October 2005), p.957, p.960, p.962; Dror Goldberg is a Ph.D. in monetary economics from University of Rochester and an Assistant Professor of Economics at Texas A&M University.

[17] International Commission for Orders of Chivalry (ICOC), Report of the Commission Internationale Permanente d’Études des Ordres de Chevalerie, “Registre des Ordres de Chivalerie”, The Armorial, Edinburgh (1978), Gryfons Publishers, USA (1996), including: Principles Involved in Assessing the Validity of Orders of Chivalry (1963), Principle 6: A “Sovereign” Order having Protection thereby becomes “an independent non-territorial power”.

[18] International Law Conventions: Status as a sovereign “subject of international law” is binding upon all countries regardless of recognition (1969 Convention on Law of Treaties, Articles 3, 38), with inherent diplomatic status by the fact of sovereignty alone (1963 Convention on Consular Relations, Articles 3, 1(d), 17.1), as a non-territorial state regardless of having any territory (1961 Convention on Diplomatic Relations, Articles 1(i), 3.1(a), 23.1, 30.1).

[19] Christopher Tyerman, The World of the Crusades, Yale University Press (2019), pp.120-121.

[20] Benjamin Z. Kedar, On the Origins of the Earliest Laws of Frankish Jerusalem: The Canons of the Council of Nablus 1120, “Speculum: A Journal of Medieval Studies”, Medieval Academy of America, University of Chicago Press, Volume 74 (1999), pp.330-331.

[21] M. Chibnall, The Ecclesiastical History of Orderic Vitalis, Clarendon Press, Oxford (1978), Volume 6, pp.308-311; In 1120 AD the High Court of Jerusalem included Count Fulk d’Anjou.

[22] High Court of Jerusalem, Decrees of the Council of Acre, Palmarea (24 June 1148); Attended by the Knights Templar, and Angevin Templar Nobility; Archbishop William II of Tyre, A History of Deeds Done Beyond the Sea (12th century), translated in: E.A. Babock & A.C. Crey, Columbia University Press (1943); In 1148 AD the High Court of Jerusalem included the 2nd Templar Grand Master Robert de Crayon, “many others” of the Knights Templar, and the Angevin King Louis VII of France.

[23] Templar Coins, Kingdom of Jerusalem “Bezant” Coins, Artifacts (ca. 1250 AD), British Museum, Accession No. 984292, No. 984293; Gold Coins, featuring distinctive Templar Seal of “Agnus Dei”; Diameter 22 millimeters, Average Weight 3.33 grams.

[24] Charles G. Addison, The History of the Knights Templars, Longman Brown & Green, London (1842), Preface, p.xi.

[25] Steven Runciman, A History of the Crusades, Volume 2: “The Kingdom of Jerusalem”, Cambridge University Press (1952), pp.212-213, 222-224.

[26] Templar Coins, Principality of Tripoli “Moneta” Coins, Artifacts (ca. 1137 AD), The Paul Edis Collection: Coins of the Crusades; Copper Coins, featuring Templar Cross Paté; Average Weight 1.0 grams.

[27] Christopher Tyerman, The World of the Crusades, Yale University Press (2019), pp.120-121.

[28] Rory Naismith (Editor), Money and Coinage in the Middle Ages, Series: “Reading Medieval Sources” (Volume 1), Lucia Travaini, Chapter 13: “Coins and Identity: From Mint to Paradise”, Brill, Leiden (2018), pp.336-337.

[29] Templar Coins, Principality of Tripoli “Moneta” Coins, Artifacts (ca. 1137 AD), The Paul Edis Collection: Coins of the Crusades; Copper Coins, featuring Templar Cross Paté; Average Weight 1.0 grams.

[30] Christopher Tyerman, The World of the Crusades, Yale University Press (2019), pp.120-121.

[31] Old Testament, Authorized King James Version (AKJV), Cambridge University Press (1990), Psalm 115:1.

[32] Webster’s Collegiate Dictionary, 3rd Edition, Merriam Co., Springfield, Mass (1916), “Alchemy”, p.25.

[33] Henri de Curzon, La Règle du Temple, La Société de L’Histoire de France, Paris (1886), in Librairie Renouard, Rules 1, 2, 12, 37, 46, 57.

[34] Saint Bernard de Clairvaux, Liber ad Milites Templi: De Laude Novae Militae, “Speech on Knights of the Temple: In Praise of the New Knighthood” (ca. 1136 AD); Translated in: Conrad Greenia, Bernard of Clairvaux: Treatises Three, Cistercian Fathers Series, No. 13, Cistercian Publications (1977), pp.127-145, “Chapter 4”.

[35] Saint Bernard de Clairvaux, Liber ad Milites Templi: De Laude Novae Militae, “Speech on Knights of the Temple: In Praise of the New Knighthood” (ca. 1136 AD); Translated in: Conrad Greenia, Bernard of Clairvaux: Treatises Three, Cistercian Fathers Series, No. 13, Cistercian Publications (1977), pp.127-145, “Chapter 5”.

[36] François Velde, Nobility and Titles in France, Heraldica (1996), updated (2003), “History of Nobility: Titles of Nobility: Titles as Offices”.

[37] François Velde, Nobility and Titles in France, Heraldica (1996), updated (2003), Chapter “History of Nobility”, Sections “Acquisition of Nobility”, “Numbers”.

[38] François Velde, Nobility and Titles in France, Heraldica (1996), updated (2003), “History of Nobility: Acquisition of Nobility”.

[39] Guy Chaussinand-Nogaret, The French Nobility in the Eighteenth Century, Cambridge University Press (1985).

[40] François Velde, Nobility and Titles in France, Heraldica (1996), updated (2003), “History of Nobility: Acquisition of Nobility”.

[41] Henri de Curzon, La Règle du Temple, La Société de L’Histoire de France, Paris (1886), in Librairie Renouard, Rules 2, 8, 9.

[42] Pope Innocent II, Omne Datum Optimum, “Every Good Gift” (29 March 1139); Translation in: Malcolm Barber & Keith Bate, The Templars: Selected Sources, Manchester University Press (2002), pp.8, 59-64.

[43] Sean Hutchinson, The Weird Assassin’s Economy of ‘John Wick’ is a Legit Black Market, “Inverse” Magazine (10 February 2017); Interview with Yuliya Zabyelina, Assistant Professor at John Jay College of Criminal Justice.

[44] Adam Ozimek, Understanding the John Wick Economy, “Forbes” Magazine (09 April 2017); Adam Ozimek is an Economist at Moody’s Analytics.

[45] Eatwell, Milgate & Newman (Editors), The New Palgrave: A Dictionary of Economics, 1st Edition, Palgrave Mcmillan Publishing (1987), Volume 4, “Real and Nominal Quantities”, pp.97-98, “Real Income”, pp.104-105.

[46] Calculator, Currency Converter: 1270-2017, “Purchasing Power”, The National Archives, Surrey UK [Calculator]; 1270 AD 1 Pound (purchases 1 Horse, or 100 days skilled wages) = 2017 AD 730 GBP ($900 USD).

[47] Calculator, Purchasing Power of British Pounds from 1270, The Measuring Worth Foundation, Illinois (2006) [Calculator]; 1270 AD 1 Pound = 2017 AD 900 GBP ($1,100 USD).

[48] Equine.com, Horses for Sale: Prices, Cruz Bay Publishing, Boulder, Colorado (2020) [Listings]; Over 560 of 1040 horses listed at “Under $2,500” with individual listings averaging $1,000 USD.

[49] Douglas Harper, Online Etymology Dictionary, Pennsylvania (2001), “Chivalry”, “Cavalier”.

[50] Henri de Curzon, La Règle du Temple, La Société de L’Histoire de France, Paris (1886), in Librairie Renouard, Rules 227, 260.

[51] Community Currencies in Action, People Powered Money: Designing Community Currencies, New Economics Foundation, London (May 2015), Chapter 2 “Money with a purpose”, p.47.

[52] Stephen DeMeulenaere, 2006 Annual Report of the Worldwide Database of Complementary Currency Systems, International Journal of Community Currency Research, Volume 11 (2007), pp.30-31.

[53] Community Currencies in Action, People Powered Money: Designing Community Currencies, New Economics Foundation, London (May 2015), Chapter 2 “Money with a purpose”, p.47.

[54] Community Currencies in Action, People Powered Money: Designing Community Currencies, New Economics Foundation, London (May 2015), Chapter 5 “Choosing the Key Features”, Section “Taking Money Out of Circulation”, Table 2, p.107: “Brixton Pound – Only businesses can exchange back to Pounds Sterling”; “SoNantes – [Only] Units purchased by consumers can be changed back to Euros”.

[55] Henri de Curzon, La Règle du Temple, La Société de L’Histoire de France, Paris (1886), in Librairie Renouard, Rule 58.

[56] Alan Butler & Stephen Dafoe, The Warriors and Bankers, Lewis Masonic, Surrey, UK (2006), p.18.

[57] Alan J. Forey, The Templars in the Corona de Aragon, Oxford University Press (1973), p.351.

[58] Piers Paul Read, The Templars: The Dramatic History of the Knights Templar, 2nd Edition, Phoenix Press, Orion Publishing Group, London (2001), p.183.

[59] Community Currencies in Action, People Powered Money: Designing Community Currencies, New Economics Foundation, London (May 2015), Chapter 5 “Choosing the Key Features”, Section “Bonus and Malus in Action”, p.111: “Brixton Pound… had a malus [service fee] of 10% for those businesses who exchanged their Brixton Pounds into Pound Sterling.”

[60] Rory Naismith (Editor), Money and Coinage in the Middle Ages, Series: “Reading Medieval Sources” (Volume 1), Chapter 1: “Introduction”, Brill, Leiden (2018), pp.7-8.

[61] John Bouvier & Francis Rawle (Editors), Bouvier’s Law Dictionary and Concise Encyclopedia (1839), “3rd Revision” (8th Edition), West Publishing, St. Paul Minnesota (1914), Volume 3: “Partnership”, p.2496; “Specific Performance”, p.3102.

[62] Emile Leon Gautier, La Chevalerie (1883); Translated in: Henry Frith, Chivalry, George Routledge & Sons, London (1891); Reconstructed from historical sources since ca. 1066 AD; “Commandment VII” (7th Pillar), “Commandment VIII” (8th Pillar), “Commandment IX” (9th Pillar).

[63] Henri de Curzon, La Règle du Temple, La Société de L’Histoire de France, Paris (1886), in Librairie Renouard, Rules 56, 63.

[64] The Vatican, The Code of Canon Law: Apostolic Constitution, Second Ecumenical Council (“Vatican II”), Enacted (1965), Amended and ratified by Pope John Paul II, Holy See of Rome (1983); “Heresy” and “Schism”: Canon 751; “Excommunication”: Canon 1364, §1.

[65] The Vatican, The Code of Canon Law: Apostolic Constitution, Second Ecumenical Council (“Vatican II”), Enacted (1965), Amended and ratified by Pope John Paul II, Holy See of Rome (1983); “Penance”: Canon 1342, §1; Canon 1357, §1; “Absolution”: Canon 508, §1; “Repentance” and “Reparation”: Canon 1347, §2.

[66] Rory Naismith (Editor), Money and Coinage in the Middle Ages, Series: “Reading Medieval Sources” (Volume 1), Lucia Travaini, Chapter 13: “Coins and Identity: From Mint to Paradise”, Brill, Leiden (2018), p.333.

[67] Henri de Curzon, La Règle du Temple, La Société de L’Histoire de France, Paris (1886), in Librairie Renouard, Rules 227, 260.

[68] The Vatican, The Code of Canon Law: Apostolic Constitution, Second Ecumenical Council (“Vatican II”), Enacted (1965), Amended and ratified by Pope John Paul II, Holy See of Rome (1983); “Penalty of Penance”: Canon 1326, §2; Canon 1357, §1.

[69] Rory Naismith (Editor), Money and Coinage in the Middle Ages, Series: “Reading Medieval Sources” (Volume 1), Chapter 1: “Introduction”, Brill, Leiden (2018), p.8.

[70] Rory Naismith (Editor), Money and Coinage in the Middle Ages, Series: “Reading Medieval Sources” (Volume 1), Richard Kelleher, Chapter 6: “From the Commercial Revolution to the Black Death”, Brill, Leiden (2018), p.126.

You cannot copy content of this page